QuickBooks 1099 Training Guide

How much time have you spent chasing down subcontractors for their addresses and tax ID? With only one month to gather independent contractor information and submit to the IRS, anything that saves you from having to pester a small business is quite welcome.

When submitting 1099-MISC Forms, it can be confusing to determine who qualifies. QuickBooks Online’s Contractors Center takes care of the requirements for you!

We have the perfect video course demonstrating all the information below for just $19 at our online, on-demand QuickBooks 1099 training class!

Independent Contractors and 1099s

An Independent Contractor is a Vendor you pay over $600 in a year for services. They are self-employed or an LLC (S-Corps are exempt).

In January, you must send all your subcontractors 1099-MISC Forms if you paid them by cash, check, or ACH, and file a 1096 with the IRS.

This helps the IRS ensure that your payments are not “under the table,” and that the subcontractor is declaring their full income and paying appropriate taxes.

It’s a good idea to have every independent contractor fill out a W-9 form as soon as you hire them. Don’t wait until after they’ve qualified. That way you’ll know if they’re an LLC or Incorporated, and you won’t have to chase them down for their addresses and Social Security Numbers or EINs in a deadline panic. And since you don’t know how much you’ll spend with them, you may as well cover all the bases.

The Contractors tab makes all this easy! QuickBooks Online’s new Contractor Center allows you to email new Subcontractors for their W-9 information when you first set them up as a Vendor. That information flows through seamlessly to QBO’s 1099 E-filing tools.

By accepting your invitation, Intuit leverages QuickBooks Self-Employed as a W-9 reporting center that Subcontractors can use to consolidate all the 1099s they receive, all in one place. If they wish, your Vendors can turn this free QBSE portal into a paid subscription for their own business’s financial tracking.

The QuickBooks Workers Center

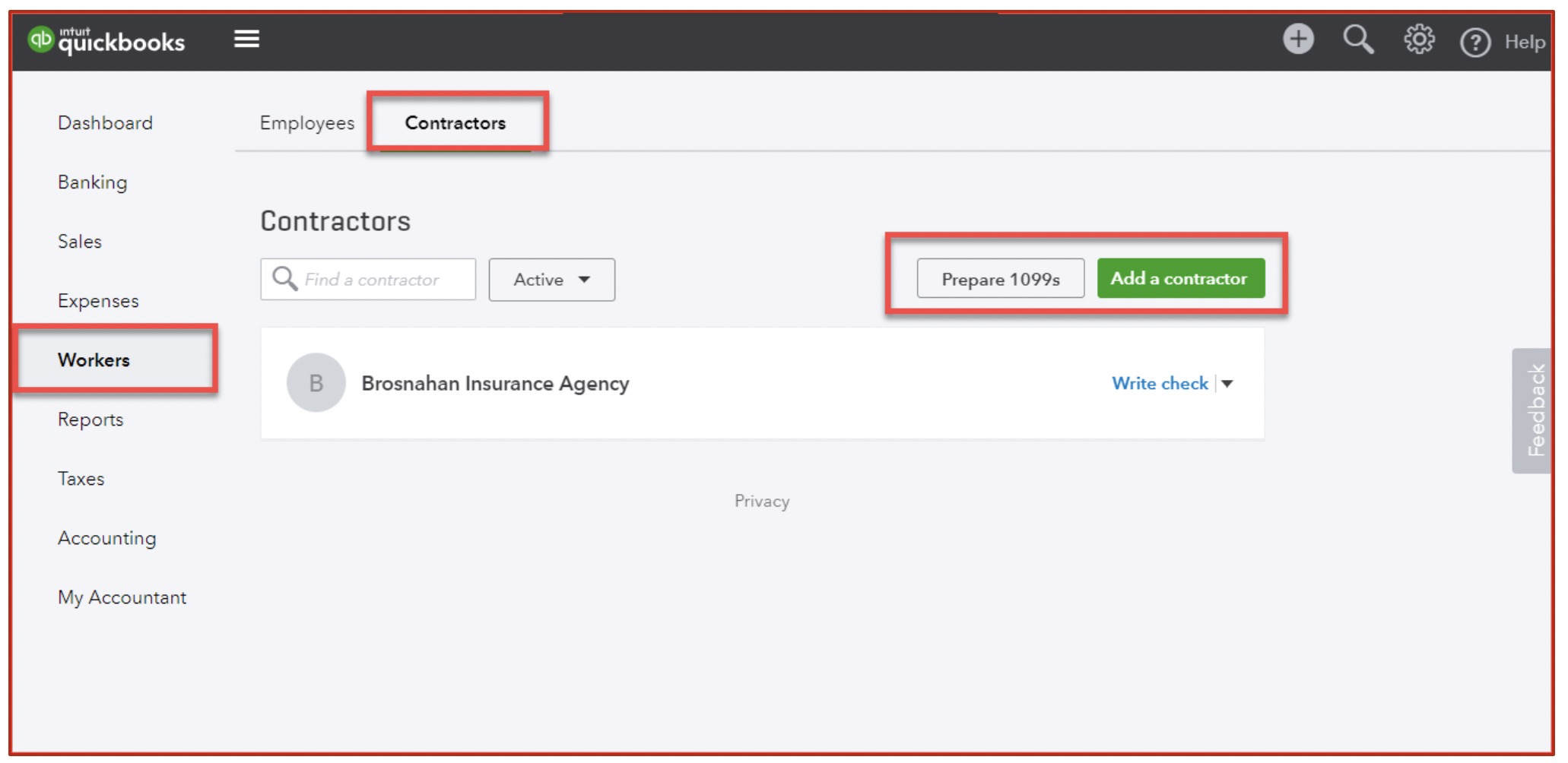

Use the Workers Center for paying your Employees and your Subcontractors. By using Workers as a starting point, you have a one-stop shop for running Payroll and managing contract labor.

Click on Workers in the left navigation bar, then the Contractors tab.

The tab in the Workers Center for Employees is where you run Payroll, but that’s another topic!

Adding Contractors in QuickBooks

Your 1099 Vendors show on this list in one of two ways:

Existing Vendors

Existing Vendors

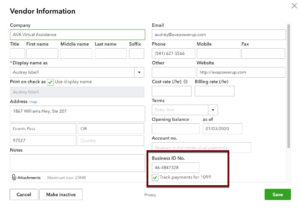

Edit the Vendor Card over in the Expenses > Vendors list. Check off Track Payments for 1099 on the bottom right. You can also fill in their address, email, and EIN numbers in this window.

Once this is checked off, the Vendor will also appear on the Contractors list for use in the 1099 tools.

New Contractors

Click the green “Add a Contractor” button. Fill in the Contractor’s name and email address.

The Contractor’s Experience

QBO sends the Vendor an online W-9 form to fill out electronically. Accepting the invitation creates their W-9, which flows into your QBO account.

This also creates a free QuickBooks Self-Employed subscription for the Contractor. All 1099s they receive through QBO are listed in this new portal. The Contractor is welcome to turn this portal into their own copy of QuickBooks for their own use!

Paying Contractors in QuickBooks Online

Instead of managing your Vendor transactions in the Vendor Center, use the tools here.

Instead of managing your Vendor transactions in the Vendor Center, use the tools here.

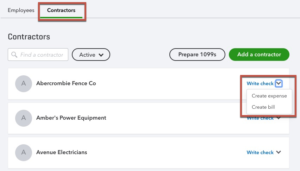

Click the blue Write Check link to pay Contractors for their services, or click the dropdown arrow to create a Credit Card Expense or a Bill.

If you subscribe to QuickBooks’s built-in Payroll, you can also pay your Contractors right in this interface using Direct Deposit for just $2/mo each.

Managing Contractors in QuickBooks Online

Click on the Contractor’s name to view their history.

Details

The Details tab has their contact information, and you can connect their bank account to pay them directly through this interface.

Payments

The Payments tab allows you to filter your payments by Date, Type, and Payment method.

Documents

The W-9 filled out through Intuit’s tools can be found in the Documents tab.

Sending 1099s in QuickBooks Online

In January, click Prepare 1099s. Use the Wizard to send 1099-MISC forms to your Subcontractors and submit your 1096 to the IRS. File by January 28 to make sure everything’s postmarked by January 31. File early for discounted rates!

Box 7: Nonemployee Compensation

PEBCAK! Be sure to check off ALL relevant expense accounts in Box 7. This filters the Wizard, and you don’t want to leave anyone out. Common contractor accounts include Advertising & Marketing, Legal and Professional Fees, Repairs and Maintenance, and Contract Labor.

Gather Missing Information

The next step in the wizard allows you to gather missing Contractor data.

Filter the List

Once you have all the necessary names, addresses, and tax IDs, the 1099 wizard shows you all the contractors who you have:

Once you have all the necessary names, addresses, and tax IDs, the 1099 wizard shows you all the contractors who you have:

- Paid more than $600 in the fiscal year

- Paid from your bank account

- Worked in the categories you select

The 1099 Wizard automatically omits anyone paid by credit card, debit card, and PayPal, because the merchant services companies submit their own 1099K forms.

Verify that no one is missing. If they are, click the Back button and double-check your Box 7 accounts and Vendor transaction list.

Submit

When you’re ready, click Finish preparing 1099s. You can e-file your 1099-MISC Forms right in QBO, send copies of 1099s to subcontractors in the mail, and submit forms to the IRS.

In 2020, the price was $15.99 for three contractors, and $5 for each additional. If you submit early, the price was $12.99.

The is also an option to print your own forms and send them manually.

Making Corrections

As of now, there is no way to correct mistakes after you’ve submitted.

You can submit paper forms with a checkmark in the Corrected box.

Filing with your State

The 1099 wizard doesn’t file with your State. You may need to take additional steps.

These states don’t require 1099s:

- Alaska (AK)

- Florida (FL)

- Illinois (IL)

- New Hampshire (NH)

- Nevada (NV)

- New York (NY)

- South Dakota (SD)

- Tennessee (TN)

- Texas (TX)

- Washington (WA)

- Wyoming (WY)

For all other states, you’ll need to mail in your printouts, or go to your state’s Department of Revenue website and submit your 1099s there.

If you live in Oregon, like I do, the unfortunate truth is that 1099s can no longer be mailed, in the way you used to be able to. Now OR only accepts uploads of 1099 data through their website.

Oregon

If you live in Oregon, here’s how to proceed. Hopefully this will also be useful to you in other states!

There are three upload methods: a text file, manually typing (copy/pasting) the data into a form, and creating a spreadsheet using their template that uploads into iWire. If you only have a few, it may just be fastest to enter them manually by filling in their webform. If you have more than a handful, go the spreadsheet route:

Open up the PDFs you generated in QBO, and copy/paste the info into this spreadsheet. We provide you with this spreadsheet in our free 1099 course – click here to register.

- Then go to https://revenueonline.dor.oregon.gov/tap/_/

- Choose “Spreadsheet from DOR Template”.

- Fill in the form with your contact info, and begin uploading from there.

Here are additional helpful links:

- iWire info page: https://www.oregon.gov/DOR/programs/businesses/pages/iwire.aspx

- iWire submission page: https://revenueonline.dor.oregon.gov/tap/_/

1099 Exclusions

Which payments can you leave off the 1099 form?

The following payments don’t have to be reported on Form 1099-MISC:

- Generally, payments to a corporation.

- Payments for merchandise, telegrams, telephone, freight, storage, and similar items

- Payments of rent to real estate agents. But the real estate agent must use Form 1099-MISC to report the rent paid over to the property owner

- Wages paid to employees (report on Form W-2, Wage and Tax Statement)

- Military differential wage payments made to employees while they are on active duty in the Armed Forces or other uniformed services (report on Form W-2)

- Business travel allowances paid to employees (may be reportable on Form W-2)

- Cost of current life insurance protection (report on Form W-2 or Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.)

- Payments to a tax-exempt organization including tax-exempt trusts (IRAs, HSAs, Archer MSAs, and Coverdell ESAs), the United States, a state, the District of Columbia, a U.S. possession, or a foreign government

- Payments made to or for homeowners from the HFA Hardest Hit Fund or the Emergency Homeowners’ Loan Program or similar state program (report on Form 1098-MA)

- Certain payment card transactions if a payment card organization has assigned a merchant/payee a Merchant Category Code (MCC) indicating that reporting is not required

If you’ve read this far, you’ll want to watch our video, too! Click here to register and watch it now – It’s only $19!

For unlimited QuickBooks support for all your questions, click below to learn more about our QuickBooks mentorship program!

If I have a 1099 contractor I have already paid in this calendar year, but don’t get them check marked track payments for 1099s until after. Will Prior to that date payments be available to include on your Year end 1099?

Rather than being provided with a 1099 form in the mail, which I prefer, I have been sent a link to sign up for a free QuickBooks account, which I neither need nor want, in order to access my 1099.

Is this even legal?

This isn’t about receiving your 1099s from your clients, which you will anyway. This is for sending them your W-9 forms. It’s actually pretty slick – by creating the free account, it stores your company info for all of your clients who also use QBO. They’ll have your W-9 info automatically instead of you having to manually send the W-9 forms to every single one of them. You don’t have to use the QBO Self-employed file for your own books unless you want to.

I am trying to send a 1099 to an APO (army post office), I have the address entered into QuickBooks online but it is asking me to update the address. What should I do?

Sorry I didn’t see this until it was too late, but here’s my answer! This is one of those cases where QBO’s 1099 tool isn’t robust enough. I would make an account at track1099.com, which integrates with QBO, and send it from there.

Once you file the 1099s using QBO, how can you check to confirm the 1099s have been acknowledged?

Thanks,

John

You will receive an email from the IRS when your forms have been accepted.

Don’t make a mistake on 1099s if you’re using QBO to process and submit because QBO doesn’t handle corrected 1099s to recipient or amended 1096 to IRS. Your on your own to get that taken care of manually. Not good at all:

It’s true that one of the limitations of QBO’s tool is that you can’t make amendments, only file new forms. I agree that this is a drawback – please use the Feedback under the Gear to let them know that this is an issue!

Can 1099 contractors receive an email from quickbooks online to download their copies of their 1099 when it’s ready? Or is the only option for us to print and mail them to the contractors?