PayPal has a new service called PayPal Credit. It’s a credit card, sort of.

By default, if you don’t have enough money in your PayPal account for a purchase, PayPal transfers money out of your bank account automatically. If you turn on PayPal Credit, this balance will accumulate in your credit account by instead.

The benefit is that instead of constant charges hitting your bank account (some of them partial because you had some money in your PayPal account but not enough), you only have one total bill to pay at the end of the month.

But that’s the only benefit. The drawbacks are plenty.

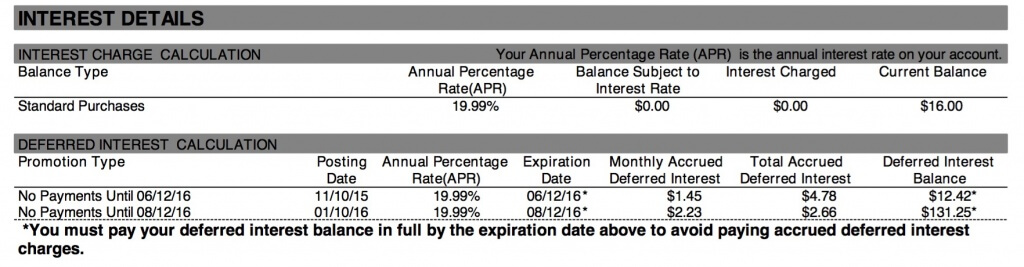

First, PayPal Credit’s interest rate is 19.99%. They offer a promotional period of no interest for 6 months…but the fine print is telling:

Even though you don’t pay interest when you open the account, you’re still accumulating interest that will come due when your promotion expires, if your purchases haven’t been paid in full.

The second drawback is how confusing PayPal Credits looks inside accounting software like QuickBooks Online. Not only do you see the actual expense in your PayPal register, but you also see the charges listed in your PayPal Credit Card register. Then when you pay the outstanding balance, you see the payment in your bank account, and the money goes to your PayPal account…and then gets transferred to the PayPal Credit account.

It’s so confusing that unless you are extremely careful, you can duplicate your expense up to four times!

To prevent this, only categorize the expense when you’re looking at the PayPal register. Don’t track the PayPal Credit card expenses at all. Use Transfers to move money between PayPal, your bank account, and PayPal Credit.

To see a demonstration, please watch our video on YouTube:

Or maybe QBO just needs to figure out how to handle it lol. So many small business owners fund their business using this tool, especially those of us that have seasonal revenue and need to cover cost of goods up front. No one else provides free money for 6 months – does intuit?

Omg, why?!?!?! Just why would PayPal do this?! I hate them to begin with and now this crap. Oh I want to cry.

Thank you so much for the explanation. I could not figure out for the life of me what this was and how to categorize it for a clean up job I am doing.

This is the biggest QB mess – I am doing THREE cleanup jobs right now and only one of them has PayPal CREDIT in the mix- What a nightmare! Thank you, Alicia. I thought I was losing it! This is ugly & messy & now it is going to take forever… UGH!

Thank you for the video Alicia. I am trying to complete my 2019 taxes and there are so many transactions in Paypal its difficult to sort through. I tried to add Paypal Credit as a new account but in Quickbooks but it will not allow me as I already have my Paypal … how are you able to do that? Thank you, Tricia

Set up PayPal Credit as a credit card, but you may not be able to sync both the regular PayPal bank account and the credit card account. Treat the credit card account as a clearing account instead. Yet another reason why I recommend that clients avoid PayPal Credit…