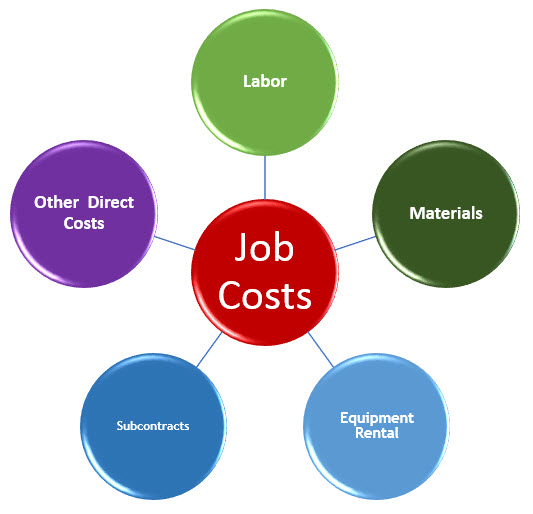

QuickBooks has a powerful Job Costing feature that allows you to compare the income you made from a job to the expenses you incurred to provide the product or service. It allows to you see if a project was profitable or not.

QuickBooks has a powerful Job Costing feature that allows you to compare the income you made from a job to the expenses you incurred to provide the product or service. It allows to you see if a project was profitable or not.

If you’re a contractor or other professional who really wants to know if you’re making any money on the jobs you do, Job Costing is essential, especially if your job expenses include payroll. Sometimes you may feel like you made a bunch of money, but not realize that your labor costs were so high that you barely made a profit!

If you’re using Intuit Payroll through QuickBooks, and using Timesheets to track Employee Hours, applying those hours to a Customer: Job is automatic, and Job Costing reports show your profit margin.

But if you’re like most small businesses, you use an outside payroll service such as ADP, your accountant process your payroll, or you just write checks yourself. In these scenarios, your payroll expenses don’t show up on your Profit & Loss report, even if you assign them to Customer:Jobs. You have to use a workaround!

Job Costing in QuickBooks Workaround

Create Two New Accounts in Your Chart of Accounts

- Payroll Service Clearing, a Bank account

- Payroll Job Costs, an Expense account

Create Items for your Estimates and Invoices

- It must be a 2-sided service item (check the box that says the work is purchased or performed by a subcontractor)

- It doesn’t matter what you put in the Sales section, since it won’t be used for that.

- In the Purchases section:

- Cost – enter full payroll cost, including wages, taxes & benefits

- Account – use Payroll Job Costs

Set Up Your Employees

Now, let’s look at your staff. Each person should be created either as a Vendor or an Other Name, instead of an Employee. If you already have them in as employees, make a new Other Name, with a slight variation (no two names can be exactly the same). You’ll use this new account moving into the future.

Track Employee Hours

To track the hours, use the Timesheet for each of the new Vendors/Other Names, with each entry applied to a Customer:Job. Don’t check Billable unless you’re passing on costs for the customer to pay.

Write a Check

Once the hours are in, write a check. It will have a $0 dollar amount. The purpose is simply to move the cost from an Expense to a trackable cost.

- Use Payroll Service Clearing as the Bank at the very top.

- Enter Employee’s Vender/Other name.

- Use the “Add Time/Costs” button to add time charges to the check (you may also get a popup asking if you want to add items; say yes). They will appear on the Items tab at the bottom.

- Switch to the Expenses tab.

- Enter the Account Payroll Job Costs.

- Enter a negative dollar amount to zero out cost from Items tab.

That’s it!

To see this technique in action, watch this video from the Sleeter Group.

Thank you for your information.

This is the most useful blog I had ever seen. Thanks or your blog !

Tumbling to pull out your blog again, it’s been quite a while for me. I need this article to finish my school task. Thankful to you.

Thankyou for writing such informative content. I really liked it and appreciate your effort in writing such wonderful content. I will really appreciate if you can help to setup roadrunner email setting.

I really liked your content. It is quite helpful and interesting. I really appreciate if you can share something on Hp printer in error state. Many user faces this issue while using hp printer.

Thankyou for sharing this interesting article, It was quite informative and looking for more such article from your end. I would appreciate if you can help me on how to fix hp printer not printing.

Thank you for this article. I really liked your article and i hope it might have helped the user. I would appreciate if you will help me on how to access iCloud photos on window PC.

access icloud photos on windows pc

Thankyou for this article. This is quite informative and interesting. I really appreciate your effort is creating such a wonderful content. It will appreciate if you will add some light on how to access icould photos on PC.

https://royalwise.com/product/iphone-ipad-cameras-photos-and-the-icloud-photo-library/

what is the income account for the item?

It doesn’t really matter, since you will never use it as an Income line item. You can point it to your main Income category.

Do I set up the employee to track labor costs in the Vendor Center or the Employee Center? When i set them up in Vendor Center I don’t see where to add time and costs. it just sets up as a vendor bill. I think i’m doing something wrong.

Thanks,

Yes, Employees do need to be set up as Employees to use Payroll features. But if you’re not seeing time and costs with vendors, you probably don’t have the features turned on in the preferences!

Hi Alicia,

I work for a payroll service provider and we have a client using QB contractor desktop. We have created QB formatted output file to match the clients needs for job #, dept, hours and dollars. However, the client says the file cannot be imported. I noticed the output file segregates the data fields with a ! expression and not sure if this causes an issue during QB importing process. Can you provide any guidance on this so we can help our client?

Hi Stan, I would have to see the file to learn more, but I’m sure the ! is breaking the import. It also matters that the Chart of Accounts categories match exactly, and you may see a : character if there are subcategories. You may want to look at Transaction Pro Importer as a tool that might help.

Hi Alicia,

I have a real estate client whose employees get bonus on properties. It’s always a $500 bonus. I have a “Projects” tab where the projects are just property addresses.

First I run payroll for all her employees as usual. I then do a journal entry of $500 (for employees who earned a bonus that applies to a property) debit AND credit of wages and apply the debit to a project (or property). That way the main profit and loss doesn’t get affected. It’s just for PROJECT’s profit and loss purposes.

So for an example,

Payroll Expenses: Wages – Credit $500

Payroll Expenses: Wages – Debit $500 (under the “name” column, I put the project/property it applies to. That way it shows on the Project’s Profit & Loss statement)

My question is how would I assign taxes under this bonus if I want to be accurate of how much of it is actually a payroll tax expense? I I hope i am making sense here…

Hi Stacie, You’re doing everything right as far as the JE for job costing, but you should still run the Bonus as part of the payroll so that taxes are addressed. Bonuses are still taxable income. However, I don’t do payroll taxes so I may not be the right person to ask…!

The key to having this work is to select a “Customer:Job” on the Items tab of the Check; and leave blank the “Customer:Job” on the Expenses tab of the Check. After I figured this out, this method to allocate labor costs to a Job for clients who outsource their Payroll works like a charm.

I work for a construction company with about 60 employees. We use Excel to track time. The Excel workbook is massaged a little bit each week, then uploaded to our payroll processor, which prepares the checks and provides a journal entry to record the necessary entries.

We record job costs in a manner that appears to be somewhat similar to what you suggest in this post, in that it relies on the zero-dollar concept. However, instead of creating zero-dollar checks, we record a zero-dollar GL entry each week. The credit consists of aggregate payroll expense (hourly, overtime, salary, welder pay, truck pay, meals per diem, lodging per diem, and probably a few others I can’t remember right now, along with taxes and an estimated workers comp cost), and is not assigned to a job. The debits are aggregate payroll expense applicable to each job; the sum of all job-allocated debits equals the non-allocated credit, so the net entry is zero, and the allocation of job costs doesn’t disturb the P&L.

Management has expressed a desire to begin recording time in QuickBooks, The driving idea behind this is that the powers that be think they will be able to see a job profitability report with up-to-date labor costs — i.e., they’ll see the labor expense associated with a job on that job’s profitability report as soon as the time is entered.

But it appears as if the labor costs won’t show up on the profitability report until the payroll bill or the check is created. I’ve had one adviser tell me that combining two reports is the best way to go, while another suggests I do the zero-dollar entry daily. I’m fresh out of ideas. Can you help?

What would be the account codes that I should use? 6000 or 5000 ?

5000s are typically Cost of Goods and 6000s are typically overhead expenses, so it depends on your business. Most Payroll are 6000 accounts. Subcontractors tend to be 5000s.

Aloha, I have been using this method for almost a year now, but while it seemed to work in the beginning,but it’s impacting my P&L statement as now there’s a line for the payroll servicing account showing a negative balance. This is weird because my payroll serving “bank” account is, of course, $0.00. Please also note upon seeing this I immediately went back and checked entries to make sure payroll “check” assigned customers, etc.

I will say though that it works great for job costing!

Thanks, Gindi

I am having the same issue. I had been using this method to allocate man hours to jobs all year and now its time to run the P&L and its including the payroll job costs in the Net Income….which cannot be correct, as I post entries for the actual payroll that is run outside. So basically, we are duplicating the labor expense here. How is the corrected so the P&L is accurate?

Hi Danielle, You should be running your P&L more than at the end of the year to make sure you’re allocating correctly on a regular basis! I can’t troubleshoot without seeing your setup. It sounds like maybe your Items aren’t set up correctly, or you’re missing one of the steps. The payroll allocation isn’t zeroing itself out.

This is the method I use in Desktop… but do we have a work around for QBO? I have a client using QBO full service payroll (which may as well be third party) They use Tsheets to track hours … but we need to move the dollars to jobs in QBO? Anyone have any suggestions?

Hi Tiffany, Why not do the same thing in QBO? Tsheets syncs to QBO and exports all employee time into QBO’s Timesheets, so that part is taken care of and the rest functions the same way.

Alicia

This technique does not work once you enter the time and write the check to the account for one or more employees.

It acts like a “one and done” scenario.

No more time or entries can be made. QB’s,…you suck

A new work around is needed.

using 2015 Contractor Premier

If you have one, let m eknow.

Hi Steve, I’m not sure I understand you. This is a step you can take periodically and regularly to assign the job costs.

I seem to be having the same problem as Steve. The first time I go through this process for each employee it works perfectly. The second time I try the process for an employee is diferent. Here is what happens on the second attempt with the same employee:

I enter time on time sheet

I go to write check and when I click on the employees name there is no pop up asking me if I want to add time ( like it does at the first instance)

Anyone please help…. Very frustrated, have been trying this for hours,

Even if the popup doesn’t show up, you can click on the Add Time/Costs button in the toolbar, and you’ll have the timecard entries to add to the Invoice.

Is this in place of doing a journal entry for your payroll? Or is this in addition to; just to get the job costing in. I would only want to do this for our service employees and not our office staff.

Thank you

You can adapt this technique into your existing payroll JE if that’s the process you’re using. Otherwise, make it a separate entry so that you can track each time you do this.

Hi Alicia,

I really like the process you have described for job costing when payroll is outsourced. However, when the cost is different for each employee (we have 6) entering just one cost per item doesn’t give us the true cost per job. We don’t want to use an “average” cost but actually reflect the true cost per job depending on who worked on it. And in our case that is often 3-4 different employees.

Any ideas how to make it more accurate in this case?

Thank you,

Cecilia

Hi Cecilia,

Would it work to create several checks, one to break out each employee? The grand total is still the same to reflect your payroll, but each person can have their own transaction with their specific amount.

Hi there,

I run the maintenance and cleaning depts of a Property Management company and I invoice for the cleaning/carpets for the rentals. I have 2 cleaners and both are paid at a different rate. How do I enter their total expense to me when they are at different rates without altering my invoice to split it up between the 2 of them. Also, I invoice for carpet cleaning by the bedroom. Some 3 bedrooms are 1300 sq ft and some take longer because they are 1600 sq ft. Both are billed out at the same income rate though. How do I enter that expense when 1 takes 1 hour and the other takes an hour and a half?

Thank you for providing this work around though, it’s VERY helpful!

Hi Dana,

It really would be best to create two Product Items for each of your cleaners if they’re at different rates. But if you don’t want to, you can use the Amount field like a calculator and add the two rates together.

It sounds like your Quantity field isn’t turned on to be able to enter 1 hr or 1.5 hours. Check your Company Settings under Sales to turn these fields on.

Alicia 🙂

Where would you enter the labor burden for each job since our employee’s can be on several different jobs during the pay period?

Hi Delcie,

You can use as many rows as you want. Assign the Job/Customer under the Name on the far right of each payroll row.

Alicia