Why Mid-sized Accounting Firms Need to Adapt to Technology

Looking to get ahead? Leveraging the right technology for mid-sized accounting firms can be a real difference-maker, smoothing out your challenges and setting you up for opportunities you hadn’t imagined. While they might not have the immense resources of large enterprises, mid-sized accounting firms enjoy a level of agility and personalization that is often hard to achieve in bigger corporations. However, to truly capitalize on these advantages, it’s critical for mid-sized firms to adapt to technological advancements. Here’s why:

Technology as a Competitive Advantage

The truth is, we live in an age where technology rules the roost. From automated invoicing to complex data analytics, today’s accounting functions have been significantly enhanced by technology. This is not just a trend observed in giant corporations. Mid-sized firms have a lot to gain, too. The integration of technology allows these firms to compete with their larger counterparts by offering clients personalized and efficient solutions that are equally robust.

Improving Efficiency with Digital Tools

One of the key aspects where technology makes a massive impact is in operational efficiency. Processes that would have previously taken hours can now be completed in a matter of minutes, thanks to automation. Software applications manage data entry, payroll calculations, and even tax submissions, freeing up valuable time that can be better spent on strategic planning and decision-making. This is an undeniable advantage, especially for mid-sized firms where resource allocation needs to be exceptionally optimized.

Meeting and Exceeding Client Expectations

Today’s clients expect real-time updates and absolute transparency in operations. With client portals and online dashboards, firms can share live updates on financial data and other critical business metrics. This level of transparency not only satisfies but often exceeds client expectations. Moreover, being able to offer real-time insights is a valuable selling point that can attract higher-value contracts and long-term client relationships.

Expanding Service Offerings

The use of technology enables firms to expand their service offerings significantly. With digital tools, accountants can transition from being mere number crunchers to comprehensive business advisors. Services like cash flow forecasting, real-time performance analytics, and strategic financial consultation can be effortlessly integrated into the existing offerings, enhancing the firm’s profile and revenue streams.

Cost-Effective Solutions

Technology also brings cost-effectiveness into the equation. Digital tools often come with scalable pricing models, which means mid-sized firms only pay for the features and functionalities they actually use. This flexibility in cost structure is invaluable for maintaining a lean operation while still offering top-notch services.

How can Mid-sized Accounting Firms Leverage Technology for Growth?

The journey to fully embracing technology doesn’t have to be overwhelming, and mid-sized firms can start small and scale up as they go. Below are some tactical ways to leverage technology in your accounting firm:

- Cloud Accounting Software: Adopting a cloud accounting software like QuickBooks Online or Xero allows real-time access to financial data, not only for your team but also for your clients. This type of technology enables streamlined communication and an efficient workflow.

- E-Signature Solutions: E-signature platforms like DocuSign can revolutionize how you manage contracts and agreements. By eliminating the need for physical signatures, you can close deals faster and maintain a secure and fully digital paper trail.

- Automated Reporting: Software that automates the reporting process can be a lifesaver. Not only does it reduce manual effort, but it also allows you to offer your clients insightful analytics and timely financial reports.

- Time Tracking Tools: Efficient time management is crucial for profitability. Time tracking software can help your team stay accountable for every billable minute, enabling you to provide transparent billing to your clients.

- Client Portals: Offering a secure client portal where your clients can upload and download sensitive financial documents can provide added value and streamline communication.

- Employee Training Programs: Continuing education for your team is essential to keep up with changing regulations and technologies. Consider implementing an online learning management system that allows your staff to complete certification courses and earn CPE credits at their own pace.

Implementing the Q.U.E.S.T. Portal for Mid-sized Accounting Firms

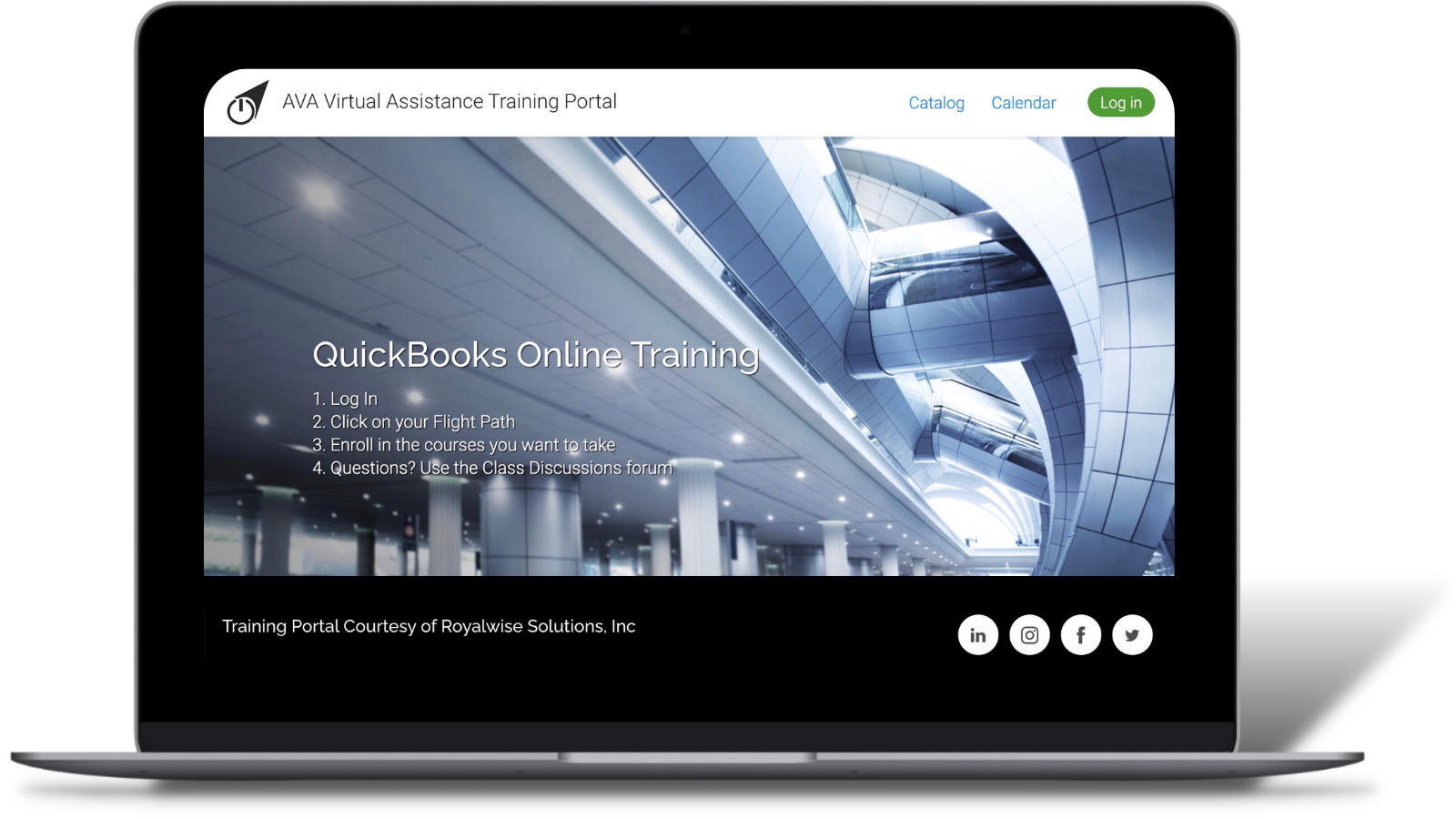

Among the myriad of options available, one turn-key solution for employee training is the Q.U.E.S.T. Portal powered by the Royalwise OWLS platform. Tailored for accounting professionals, this platform provides on-demand training in QuickBooks Online, among other valuable resources, making it an invaluable addition to your technology stack.

(A custom-branded Q.U.E.S.T. Portal. Click here to see it in action.)

Benefits for Mid-sized Accounting Firms:

The advantages of technology adoption aren’t just theoretical; they translate into tangible benefits that can significantly uplift a mid-sized accounting firm. These benefits can be the differentiators that set your firm apart in a crowded marketplace.

- Enhanced staff productivity: Well-trained employees are more productive, and our Q.U.E.S.T. Portal aims to boost their efficiency. By completing tasks in half the time and getting them right the first time, your staff can increase productivity and contribute to your bottom line. They’ll be able to tackle tasks more efficiently, allowing them to move on to the next job promptly.

- Focus on revenue-generating activities: Your primary focus should be on bookkeeping and accounting services, not spending excessive time on repetitive training. Leave that to Royalwise so that you can direct your attention and efforts towards core business activities that generate revenue.

- Streamlined compliance for your staff: Ensure that your team meets their annual Continuing Professional Education (CPE) requirements by providing them with ongoing access to educational opportunities through the OWLS platform. It’s an easy way to keep your staff compliant and up-to-date.

- Mitigating the impact of employee turnover: We understand the frustration of investing significant time and effort into training a new employee, only to have them leave before you can realize a return on your investment. A Q.U.E.S.T. Portal helps ease any pains associated with employee turnover.

Conclusion: Adapt or Risk Being Left Behind

The digital age waits for no one. For mid-sized accounting firms, adapting to technology is not just an option; it’s a necessity for survival and growth. Whether it’s enhancing operational efficiency, meeting client expectations, or expanding service offerings, technology is the tool that can make it happen. And with resources like the Q.U.E.S.T. Portal, the transition becomes smoother and more effective.

So, if you’re a mid-sized accounting firm looking to stay competitive and future-proof your practice, it’s time to embrace the technological revolution. Your future success depends on it.

Ready to Scale Your Accounting Firm?

Your Q.U.E.S.T. Portal Awaits—Let’s Connect!

Click the button below to take the first step.

Great article Payden!

Thanks, Jeff. Hope it’s useful!