Leveraging Technology as a Mid-Sized Accounting Firm

In today’s fast-paced business landscape, leveraging technology as a mid-sized accounting firm is essential if you want to stay competitive. Implementing the right technological solutions can streamline workflows, increase efficiency, and drive profitability. This article explores various ways mid-sized accounting firms can leverage technology to improve their business operations, enhance client services, and boost growth.

Cloud Computing: The Foundation of Modern Accounting

Cloud computing has revolutionized the way accounting firms operate. It provides the flexibility and scalability needed to handle large volumes of data, collaborate with clients in real-time, and access financial information from anywhere, at any time. By migrating to cloud-based accounting software, mid-sized firms can streamline their internal processes and provide better services to their clients. Cloud-based solutions offer benefits such as automated data entry, real-time synchronization, and easy collaboration with clients. This enables accountants to focus on value-added tasks, such as financial analysis and strategic planning, rather than getting bogged down by manual data entry and administrative tasks. Moreover, cloud computing provides enhanced data security and disaster recovery capabilities. With data stored securely in the cloud, mid-sized firms can protect sensitive client information and ensure business continuity in the event of a system failure or natural disaster.

Automation: Streamlining Workflows and Increasing Efficiency

Automation is a game-changer for mid-sized accounting firms. By automating repetitive and time-consuming tasks, accountants can free up valuable time and resources, allowing them to focus on more strategic and high-value activities. One area where automation can greatly benefit mid-sized firms is in data entry and bookkeeping. Advanced accounting software equipped with optical character recognition (OCR) technology can automate the extraction of data from invoices, receipts, and other financial documents, reducing the need for manual data entry and minimizing errors. Additionally, automation can be applied to tasks such as bank reconciliation, financial reporting, and compliance management. By leveraging robotic process automation (RPA) tools, mid-sized firms can automate these processes, improving accuracy, reducing turnaround time, and ensuring compliance with regulatory requirements.

Data Analytics: Unlocking Actionable Insights

Data analytics plays a crucial role in empowering mid-sized accounting firms to make informed business decisions. By harnessing the power of data, accountants can gain valuable insights into client behavior, industry trends, and financial performance. Implementing data analytics tools allows mid-sized firms to analyze large volumes of financial data quickly and accurately. By identifying patterns, trends, and anomalies, accountants can provide strategic advice to their clients, helping them optimize their financial operations and make better-informed business decisions. Furthermore, data analytics can assist mid-sized firms in identifying potential risks and fraud. By applying advanced algorithms and machine learning techniques, accountants can detect suspicious transactions, uncover fraudulent activities, and mitigate potential financial risks.

Artificial Intelligence and Machine Learning: The Future of Accounting

Artificial intelligence (AI) and machine learning (ML) technologies are transforming the accounting industry. These technologies enable mid-sized firms to automate complex tasks, gain deeper insights from data, and provide more personalized services to their clients. AI-powered chatbots can handle routine client inquiries, freeing up accountants’ time and improving client satisfaction. These chatbots can provide instant responses to common questions, assist with basic financial calculations, and guide clients through various accounting processes. ML algorithms can also be used to analyze financial data, detect patterns, and predict future trends. By leveraging ML models, mid-sized firms can provide more accurate financial forecasts, identify potential risks, and offer proactive advice to their clients.

Cybersecurity: Safeguarding Sensitive Client Data

With the rise of cyber threats, ensuring the security of sensitive client data is of utmost importance for mid-sized accounting firms. Implementing robust cybersecurity measures and protocols is essential to protect against data breaches and maintain client trust. Accounting firms should invest in state-of-the-art cybersecurity solutions, including firewalls, encryption, multi-factor authentication, and regular security audits. Additionally, employee training and awareness programs can help prevent human errors that often lead to security breaches. Maintaining compliance with data protection regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), is also crucial for mid-sized accounting firms. By implementing the necessary technological safeguards and adhering to regulatory requirements, firms can ensure the confidentiality, integrity, and availability of client data.

Client Portals: Enhancing Collaboration and Communication

Client portals are powerful tools that facilitate seamless collaboration and communication between mid-sized accounting firms and their clients. These online platforms provide a secure and centralized space where clients can access their financial documents, communicate with their accountants, and track the progress of their engagements. By using client portals, mid-sized firms can eliminate the need for back-and-forth emails and physical document exchanges. Clients can securely upload financial documents, such as invoices, receipts, and bank statements, directly to the portal, eliminating the risk of lost or misplaced paperwork. Client portals also enable real-time communication between accountants and clients, allowing for quick response times and efficient issue resolution. Accountants can address client queries, provide updates on ongoing engagements, and share financial reports seamlessly through the portal.

Integrated Software Solutions: Streamlining Workflows

To maximize efficiency and productivity, mid-sized accounting firms should consider implementing integrated software solutions. These solutions combine multiple functionalities, such as accounting, payroll, time tracking, and project management, into a single platform. By streamlining workflows and eliminating the need for multiple software applications, integrated solutions simplify processes, reduce manual data entry, and improve data accuracy. Accountants can seamlessly access and share data across different modules, eliminating the need for manual data transfers and reducing the risk of errors. Integrated software solutions also provide real-time visibility into financial data, enabling mid-sized firms to make informed decisions quickly. With centralized dashboards and customizable reporting capabilities, accountants can monitor key performance indicators, track project progress, and identify areas for improvement.

Training and Professional Development: Upskilling the Workforce

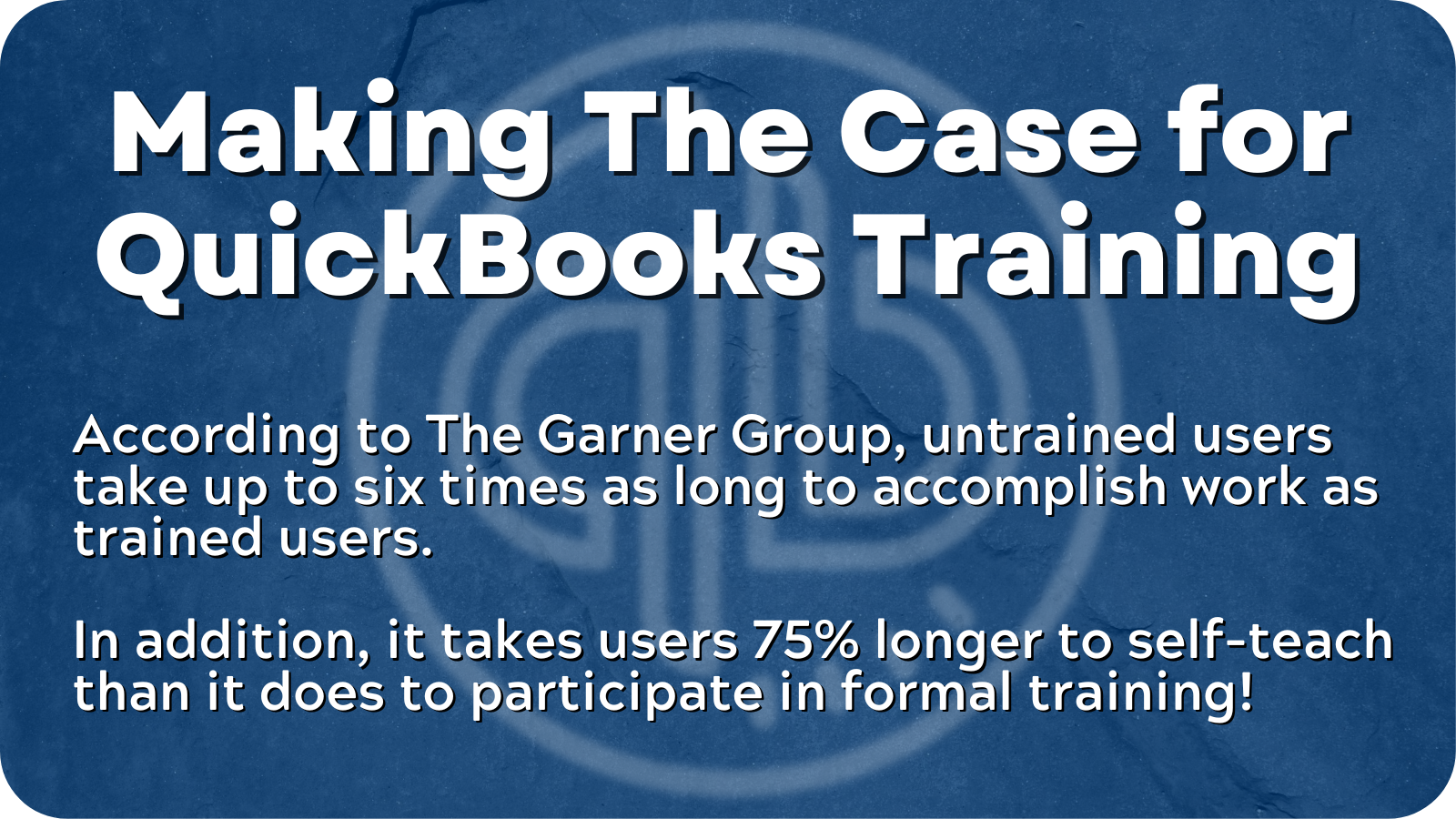

As technology continues to advance, mid-sized accounting firms must invest in training and professional development programs to upskill their workforce. Providing ongoing education and training opportunities ensures that accountants stay updated with the latest technological advancements and industry best practices. Mid-sized firms can offer internal training programs, workshops, and webinars to enhance employees’ technical skills and expand their knowledge of accounting software and emerging technologies. Additionally, encouraging employees to pursue professional certifications, such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA), demonstrates a commitment to excellence and continuous learning. By investing in the professional development of their workforce, mid-sized accounting firms can attract and retain top talent, provide better client services, and position themselves as industry leaders.

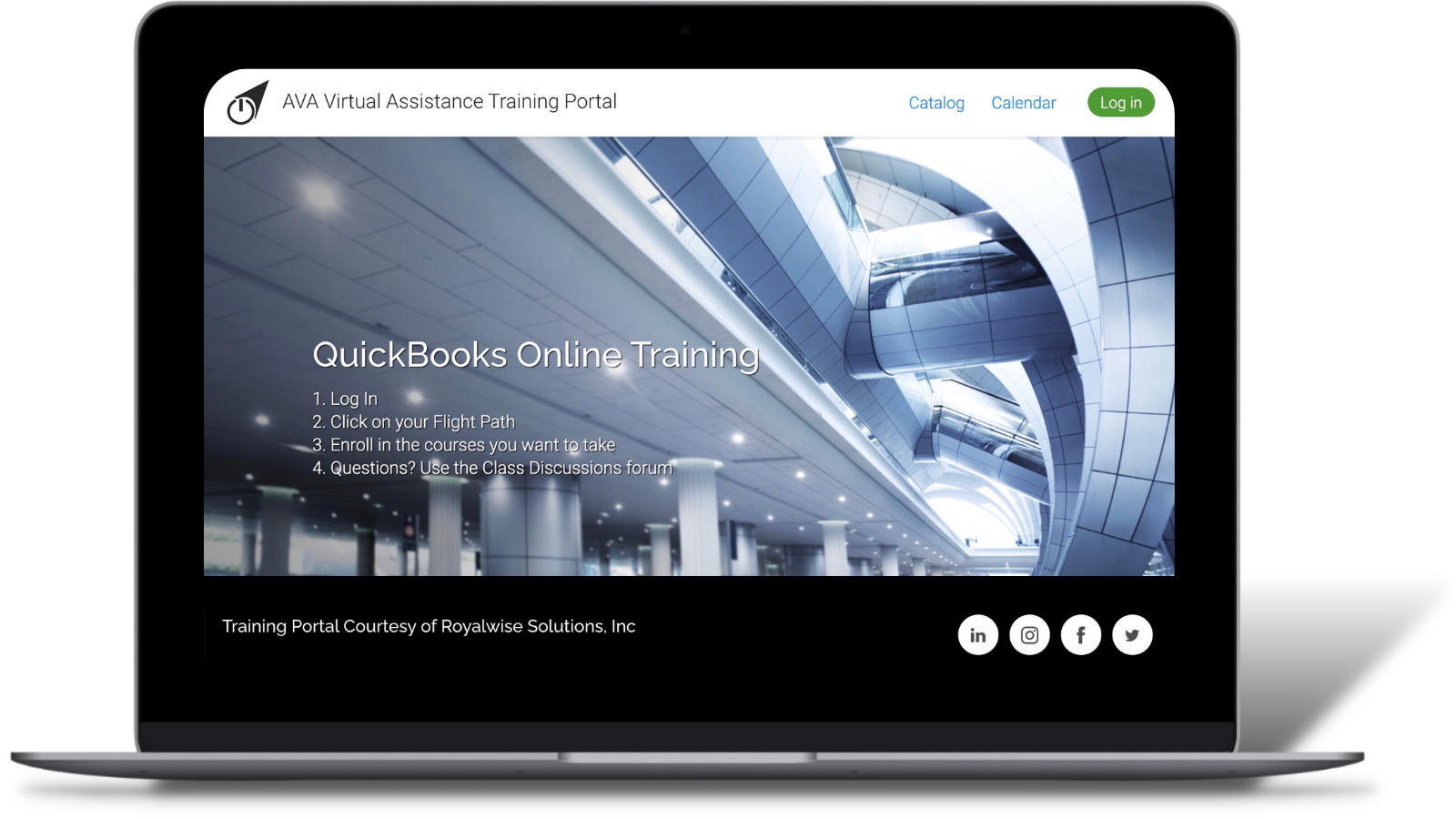

Transitioning to the QUEST Portal: Unlocking the Full Potential

To further leverage technology and enhance their operations, mid-sized accounting firms can transition to the proprietary Q.U.E.S.T. Portal offered by Royalwise.com. This platform provides comprehensive QuickBooks training and support, empowering accountants to become QuickBooks experts and efficiently manage financial processes. The Q.U.E.S.T. Portal offers scalable solutions tailored to the specific needs of mid-sized accounting firms. With a focus on video-based training, webinars, and individual support, the portal equips accountants with the knowledge and skills necessary to navigate the evolving FinTech landscape confidently. By utilizing the Q.U.E.S.T. Portal, mid-sized firms can streamline their training processes, reduce the impact of employee turnover, and enhance staff productivity. The customizable content allows firms to tailor the learning experience to their specific requirements, ensuring that employees receive the exact training they need. Moreover, integrating the Q.U.E.S.T. Portal into client billing can create new revenue streams and differentiate mid-sized firms from their competitors. By offering value-added training opportunities, firms can position themselves as trusted advisors and provide additional services that make them stand out in the market.

Conclusion

In the age of digital transformation, mid-sized accounting firms must embrace technology to remain competitive and drive growth. Cloud computing, automation, data analytics, cybersecurity, client portals, AI, integrated software solutions, and professional development are all key areas where mid-sized firms can leverage technology to improve their workflows, enhance client services, and increase profitability. Transitioning to the Q.U.E.S.T. Portal offered by Royalwise allows mid-sized accounting firms to unlock the full potential of technology. By providing comprehensive QuickBooks training and support, the portal empowers accountants to become experts in their field and efficiently manage financial processes. As the accounting industry continues to evolve, mid-sized firms that effectively leverage technology will gain a competitive edge and position themselves for long-term success. Embracing technological advancements and investing in the right solutions will enable mid-sized accounting firms to thrive in the digital era.

0 Comments